The Recent Drop In Cryptocurrency Prices Attributed To Macro-factors

The cryptocurrency prices have seen significant gains over the last five years, benefiting traders and institutional investors and the development of web3. These marketplaces were entirely different from the financial markets and had no connection. However, it has significantly risen after the year 2020. Because of this, the remainder of the financial system will become intertwined with the present demand on the market.

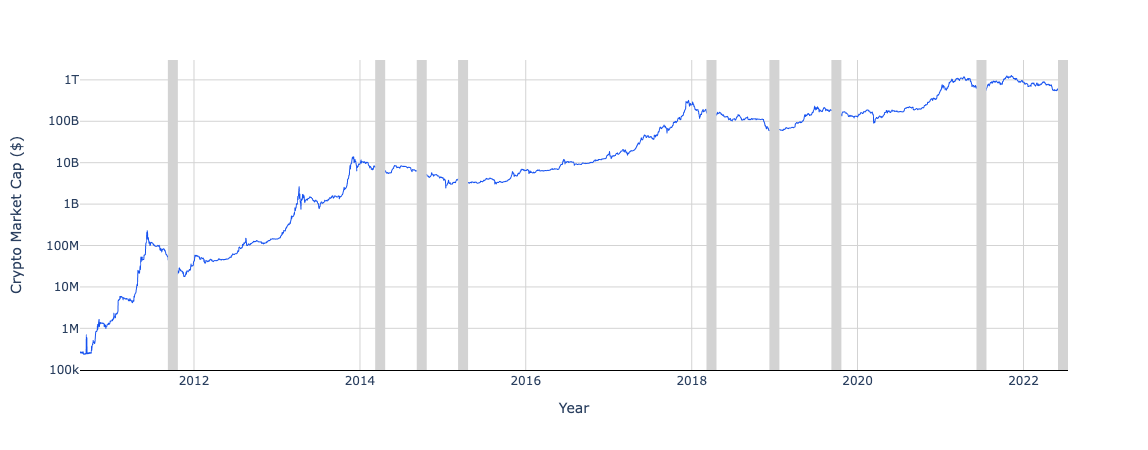

The danger associated with the cryptocurrency prices is comparable to that of oil prices and technological stock prices. This recent drop is related, at least in part, to the deterioration of macro-factors. In addition, a worsening prognosis for cryptocurrencies may be responsible for one-third of it. Since reaching its high of $2.9 trillion eight months ago, the market has been steadily declining, trading at less than one trillion dollars. It is not anticipated that it will be seen in any cryptocurrency marketplaces. However, the total market capitalization has witnessed a quarterly fall of twenty percent from 2010.

Also Read: Solana Snaps Spotlight From Ethereum, Proved Dominant In NFTs

When there is a significant drop in cryptocurrency values, the media, and other experts will often remark on the event using one of the following formats:

i) Crypto is dead.

ii) the “HODL” response.

None of them can explain the historical tendencies seen in the cryptocurrency markets.

Performance of the Market

It would help if you understood market efficiency before you test cryptocurrency marketplaces. You can understand the data as a result. For example, the total market capitalization climbed by 860 percent between June 2017 and June 2022.

Also Read: Coca-Cola Launches Pride NFT Collection

It indicates that the prospective value of the currency is higher than it was back then. Non-fungible tokens, also known as NFTs, relate to the category of unique returns, decentralized identification solutions and financial applications, tokenization of real assets, and so on.

Since 2020, the correlation between the value of stocks and cryptocurrency assets has grown. There was no correlation whatsoever between the success of the stock market and the returns on bitcoin. The connection significantly increased after after the outbreak of COVID pandemic. It is anticipated that the cryptocurrency asset will become increasingly entangled, requiring assistance from the rest of the financial system.

Recently, the assets on the cryptocurrency market have had risk profiles comparable to those of oil commodity prices and technology stocks. When it comes to financial assets, the measure of systematic risk called beta may be found. If an asset has a beta of 0, it has no connection with the market. It goes in the same direction as the market, as shown by the phrase “a beta of one.” On the other hand, a beta value of two suggests that the change in assets will be 2%, while the change in the stock market will be 1%. Ethereum and Bitcoin’s betas increased from 0 in 2019 to 1 in 2020–2021 and then to 2 presently.

Also Read: Voyager Digital Halts Trading, Deposits And Other Related Services

What lies in the future for crypto market?

The idea that markets are efficient rests on the foundation of traded assets, which includes stocks, bonds, commodities, and cryptocurrencies. For instance, if many investors believe that Tesla will continue to sell many vehicles in the future, the value of the stock will rise to reflect that expectation. No matter whether or not the firm is successful in meeting the market’s expectations in the future, there will be no rise in the price of its shares. The reason is that the company has already factored in the potential impact of that occurrence on its current valuation. The worth of anything changes whenever there is a change in the person’s perception of the future.